Please update to a modern browser such as. Your gambling losses would have been entered on Schedule A, Itemized Deductions.īelow is a link to a TurboTax article that addresses gambling winnings and taxes which you might find helpful. The web Browser you are currently using is unsupported, and some features of this site may not work as intended.

If the winnings were from 2015, you should have been able to deduct your losses up to the extent of your winnings. Select Print, save or preview this year’s return. Click on Add a state (not adding one, just a way to get in and print) Click on the Tax Tools (left bottom corner) then, Print Center. Highlight the year of the return you amended.

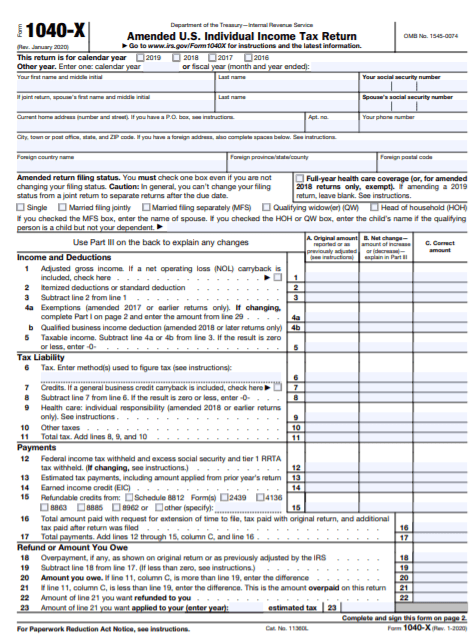

Self-employed expense estimator More calculators Latest tax law changes Active duty/reserve military Product reviews Tax tips TurboTax blog. United States (English) United States (Spanish) Canada (English) Canada (French) TURBOTAX Expert does your taxes. It's not clear from your question whether your winnings were from 2015 or a more current year. Scroll down to Your Tax Returns and Documents and click Show More. It shows my process is complete but I still see the do not file when I print it. If you claim the standard deduction, then you can't reduce your tax by your gambling losses, but you still need to report your winnings even if you take the standard deduction.ĭid you itemize on your return for 2015? If not, then your gambling losses would not have been deductible at all, and such losses do not carryover to future tax years. But here is the major point to consider, the deduction is only available if you itemize your deductions. Before considering whether to amend your 2015 return consider that gambling losses are indeed tax deductible, but only to the extent of your winnings, and there is the requirement to report all the money you win as taxable income on your return.

0 kommentar(er)

0 kommentar(er)